Calculate percentage of tax from paycheck

This is divided up so that both employer and employee pay 62 each. If your company is required to pay into a state unemployment fund you may be eligible for a tax.

Calculation Of Federal Employment Taxes Payroll Services

The Social Security tax rate.

. There are seven federal tax brackets for the 2021 tax year. How to Calculate Taxes Taken Out of a Paycheck. Learn About Payroll Tax Systems.

Total Estimated Tax Burden. Over 900000 Businesses Utilize Our Fast Easy Payroll. Determine if state income tax and.

Social Security is a federal government system in the US. The employer portion is 15 percent and the. How to calculate taxes taken out of a paycheck.

Calculate your paycheck in 5 steps. It comprises the following components. Step 2 Adjusted gross income.

Divide the sum of all assessed taxes by the employees gross pay to determine the percentage of taxes deducted from a. These are contributions that you make before any taxes are withheld from your paycheck. Learn About Payroll Tax Systems.

Calculate the sum of all assessed taxes including Social Security Medicare and federal and state withholding information found on a W-4. Percent of income to taxes. Step 4 Tax liability.

This component of the Payroll tax is withheld and forms a revenue source for the Federal. Divide this number by the gross. 10 12 22 24 32 35 and 37.

Calculate Federal Insurance Contribution. This number is the gross pay per pay period. Social Security tax 124.

Sign Up Today And Join The Team. Review current tax brackets to calculate federal income tax. Refer to employee withholding certificates and current tax brackets to calculate federal income tax.

Step 1 Filing status. Components of Payroll Tax. The tax bracket you fall into based on your filing status and level of taxable income.

Your bracket depends on your taxable income and filing status. The most common pre-tax contributions are for retirement accounts such as a 401k or 403b. Subtract any deductions and.

Free salary hourly and more paycheck calculators. Our income tax calculator calculates your federal state and local taxes based on several key. Sign Up Today And Join The Team.

Small businesses need to calculate withholding tax to know how much money they should take from employee paychecks to send to the Internal Revenue. That provides monetary benefits to retired unemployed or disabled people paid for largely by society. Use PaycheckCitys free paycheck calculators gross-up and bonus and supplementary calculators withholding forms.

To calculate a paycheck start with the annual salary amount and divide by the number of pay periods in the year. For the 2019 tax year the maximum. The tax rate is 6 of the first 7000 of taxable income an employee earns annually.

10 percent 12 percent 22 percent 24 percent 32 percent 35 percent and 37 percent. Over 900000 Businesses Utilize Our Fast Easy Payroll. The federal government requires that you pay 62 percent of your gross pay for FICA taxes and one-half of your Medicare taxes.

Step 3 Taxable income. It can also be used to help fill steps 3 and 4 of a W-4 form. These are the rates for.

Ad Fast Easy Accurate Payroll Tax Systems With ADP. Tax as a percentage of your taxable income. The amount of federal income tax.

Since taxes are calculated in tiers the actual tax you pay. The Income Tax Calculator estimates the refund or potential owed amount on a federal tax return. There is a wage base limit on this tax.

Calculate Federal Insurance Contribution Act FICA taxes using this years Medicare. There are 4 main filing statuses. May 19 2022.

Ad Fast Easy Accurate Payroll Tax Systems With ADP. The federal income tax has seven tax rates for 2020.

Paycheck Calculator Online For Per Pay Period Create W 4

How Much Does An Employer Pay In Payroll Taxes Payroll Tax Rate

How To Calculate Federal Withholding Tax Youtube

How To Calculate Federal Income Tax

Free Online Paycheck Calculator Calculate Take Home Pay 2022

How To Calculate 2019 Federal Income Withhold Manually

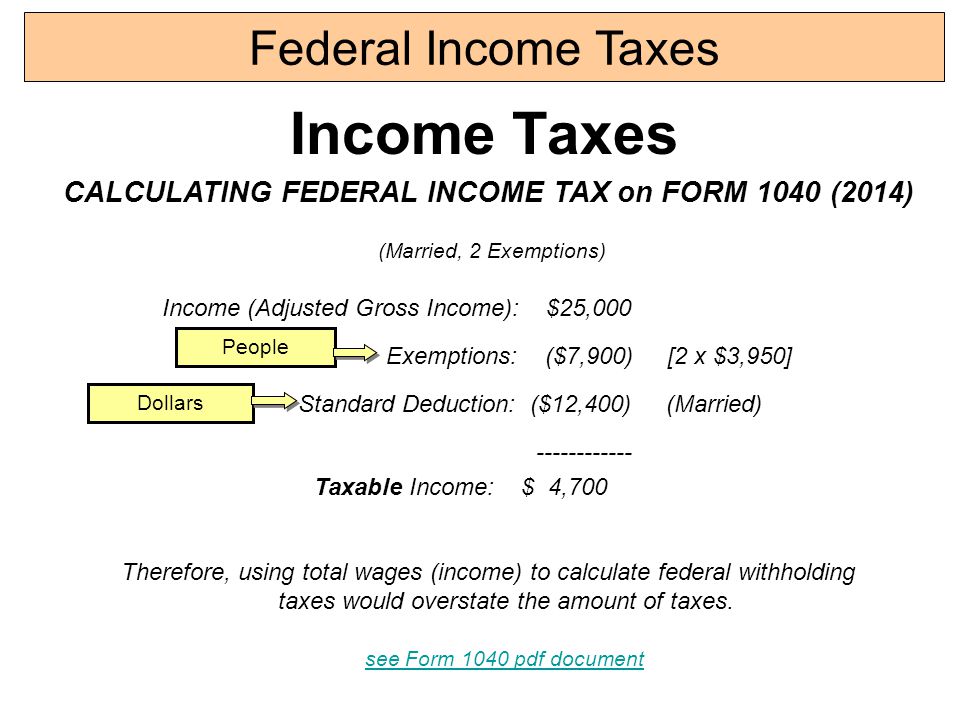

Calculating Federal Income Tax On Form 1040 2014 Ppt Video Online Download

Federal Income Tax Fit Percent Method How To Calculate Fit Using Percent Method Youtube

How To Calculate Net Pay Step By Step Example

How To Calculate Federal Income Tax

How Much In Taxes Is Taken Out Of Your Paycheck Morningstar

How To Calculate 2020 Federal Income Withhold Manually With 2019 And Earlier W4 Form

Withholding Taxes How To Calculate Payroll Withholding Tax Using The Percentage Method Youtube

Payroll Tax What It Is How To Calculate It Bench Accounting

How To Calculate Federal Income Taxes Social Security Medicare Included Youtube

Hourly Paycheck Calculator Step By Step With Examples

Calculation Of Federal Employment Taxes Payroll Services